Protect your future,

with hassle-free pensions

THE pension app to help business owners set up, combine and manage their pension, all from their mobile phone.

Increase your

wealth & save

tax

Whether you’re new to pensions or have several that you need to combine, we make the process of building your retirement capital an enjoyable, secure and stress-free experience.

Combining technology and a personal assistant, we let you experience the best of both worlds while we try to help you make the most of your investment opportunities.

We’re designed for business owners, as your pension will be registered as a self-administered pension scheme.

How Retirement Capital Transforms

Your SSAS

Retirement Capital is the UK’s first Small Self-Administered Scheme (SSAS) provider that both fully administers and delivers all your investments through a single, intuitive platform. We empower you with complete ease and control over your retirement savings. From making contributions and drawing funds to simply checking your money’s performance, our technology makes managing your SSAS better. We also take care of all the administration, including all tax returns, reporting and compliance.

Understand your pension with our

free app

Effortless Management & Complete Control

We achieve this by securely linking our platform to your banking, investments, property, and loans. Through our secured API connectivity, your financial data is seamlessly integrated into our systems. We are developing powerful AI that reads these data sets intelligently applying code.

For example, our Banking Hub gives you immediate access to both the source and reference for every transaction. Whether it’s incoming rent payments, outgoing loan payments, or investment income from your share portfolio, everything is clearly mapped out, giving you full transparency and control.

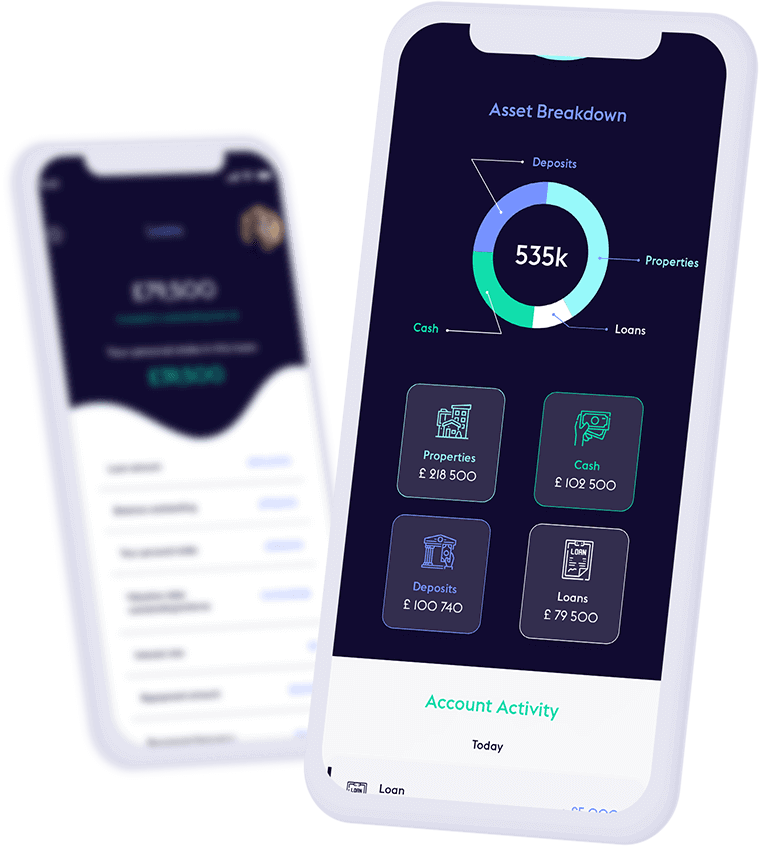

The Retirement Capital app lets you keep track of everything going on in your pension at the same time. Check on how stocks and shares are performing, manage your property portfolio in your pension and see how much cash you have available, all from within the app.

If you’re not sure about anything, you can get in-app assistance and learn more about your pension right from within the app.

Our app is free to download and is available on the App Store and Google Play.

RC are Finalists in the Moneyfacts Awards for Best use of Technology in Life, Pensions and Investments

Features

Your dashboard delivers all the key information you need including how your investments are performing in one place. We acheive this by combining the data from your pension banking, and investments, such as property, loans and share dealing accounts. Your document centre stores securely your data in a easy, readible format to access and download at your convenience.

Have control of your pension like never before. If you’ve had pensions from different jobs, you may want to combine them into one easy-to-manage dashboard. We can also transfer funds across in-specie, and this can also be managed from your dashboard.

Link your current IFA or access our financial advisory panel in the app to access FCA regulated advice to help you with the right choices.

Your intuitive and user-friendly dashboard calculates the value of your pension fund based on all your investments and the feasibility of further contributions along with tax calculations. You can see money paid in as soon as the next working day.

You can start taking money out of your pension once you hit 55 years of age. There is no restriction on the amount you can take out. Use the app to request one off payments, for key annivesary dates or for unexpected bills. The money will be in your account the next working day.

Personalised Insights

& Secure Planning

Our technology intelligently splits funds between each SSAS member, providing every individual with clear visibility of their exact share. From this, our calculation hub precisely projects how much you can expect to receive at your retirement date, giving you peace of mind and clarity.

Each member is subject to an annual allowance. Our Contribution Hub transparently displays how much has been paid in, from where, and how much of your annual allowance remains within each tax year, helping you stay on track with contributions.

If you’ve elected to take flexi-access drawdown, our user-friendly Pension Request tool simplifies the process of initiating pension drawdown from your SSAS. Our soon to be deployed updates will even recommend the optimal amount for you to take, based on real-time tax updates from HMRC.

Build your pension

your way

Whether you’re more interested in the property market or want the security of long term cash deposits, you can fully manage your pension from the comfort of your own dashboard.

Distribute your funds as you see fit – stocks, shares or invest in your own business.

Connect your current IFA to your account, or select our IFA division for regulated FCA advice.

Your Data, Secure

& Accessible

We understand the paramount importance of your financial information. That’s why we’ve stored all your essential documents in our secure Document Centre. We’ve also created a dedicated, secure portal for you to access and upload any files important to you, ensuring your data is always safe and readily available.

Expert advice at

your fingertips

We have a library of resources for you to learn more about using the Retirement Capital app and how to utilise your pension to its full potential. Check out our guides and fact sheets for more information or get in touch with one of our advisers for a more tailored answer.

A Dedicated Team, Always Here to Help

Retirement Capital SSAS was built on the direct demands and requirements of our customers. We truly believe we’ve covered the entire lifecycle of your SSAS. We’re ground-breaking and continually evolving. For any questions or support you need, our in-house chat functionality provides a direct line to our knowledgeable and friendly team. We’re here to communicate, talk, and work with you on any queries you may have.